UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

DigitalBridge Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |||||

DigitalBridge Group, Inc. 750 Park of | |||||

Suite 210 Boca Raton, Florida 33487 (561) 570-4644 | |||||

MESSAGE FROM

OUR CHAIRPERSON OF THE BOARD

To the Stockholders of Colony Capital,DigitalBridge Group, Inc.:

It is our pleasure to invite you to the 2021 annual meeting2023 Annual Meeting of stockholdersStockholders (the “2021“2023 Annual Meeting”) of Colony Capital,DigitalBridge Group, Inc., a Maryland corporation. In light of public health concerns, the 2021The 2023 Annual Meeting will be conducted virtually, via live audio webcast, on May 4, 2021,11, 2023, beginning at 11:00 a.m., Eastern Time. You will be able to attend the virtual 20212023 Annual Meeting, vote your shares and submit questions during the meeting via live audio webcast by visiting

I sincerely hope that you will be able to attend and participate in the virtual meeting. Whether or not you plan to attend the annual meeting via the live webcast, please authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares by mail, telephone or Internet. The proxy card materials provide you with details on how to authorize a proxy to vote by these three methods.

We look forward to receiving your proxy and thank you for your continued support.

| ||||||||

Sincerely,

NANCY A. CURTIN | ||||||||

Chairperson April 7, 2023 Boca Raton, Florida | ||||||||

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

| Date and Time |  | Virtual Meeting via Live Audio Webcast |  | Record Date | ||

11:00 a.m., Eastern Time | https://web.lumiagm.com/286413441 Webcast Passcode: digitalbridge2023 | You can vote if you are a stockholder of record on March 15, 2023. | |||||

| Items of Business | ||

| 1 | Election of Directors | To elect 9 directors nominated by our Board of Directors to serve until the 2024 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified; |

| 2 | Advisory Vote on Executive Compensation | To approve, on a non-binding, advisory basis, named executive officer compensation; |

| 3 | Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation | To recommend, on a non-binding, advisory basis, the frequency of the advisory vote on named executive officer compensation; |

| 4 | Charter Amendment | To consider and vote upon an amendment to our articles of amendment and restatement, as amended and supplemented, to decrease the number of authorized shares of common stock; |

| 5 | Ratification of Independent Registered Public Accounting Firm | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

| 6 | Other Business | Transact any other business that may properly come before the 2023 Annual Meeting or any postponement or adjournment of the 2023 Annual Meeting. |

Annual Meeting or any postponement or adjournment of the 2021 Annual Meeting.

Our 20202022 Annual Report to Stockholders accompanies but is not part of, these proxy materials.

Proxy Voting

Your vote is very important. Whether or not you plan to attend the virtual 20212023 Annual Meeting via live webcast, you are encouraged to read the proxy statement and submit your proxy card or voting instructions form as soon as possible to ensure that your shares are represented and voted at the 20212023 Annual Meeting.

By Order of the Board of Directors, | ||

| ||

RONALD M. SANDERS | ||

Executive Vice President, and Secretary | ||

April 7, 2023

Boca Raton, Florida

TABLE OF

CONTENTS

| |

PROXY SUMMARY | ||

DigitalBridge Group, Inc. 750 Park of Commerce Drive Suite 210 Boca Raton, Florida 33487 (561) 570-4644 | ||

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. This Proxy Statement and the enclosed form of proxy are first being mailed to stockholders of Colony Capital,DigitalBridge Group, Inc., a Maryland corporation (the “Company,” “Colony Capital,“DigitalBridge,” “Colony,” “CLNY,“DBRG,” “we,” “our” or “us”), on or about April 1, 2021.

Throughout this Proxy Statement, common stock $0.01 par valueshare and per share (“Class A common stock”)information, including units of DigitalBridge Operating Company, LLC, our operating company, and Class B common stock $0.01 par value per share (“Class B commonaward units have been revised for all periods presented to give effect to the one-for-four reverse stock” and together with Class A common stock, our “common stock”), as of the close of business on March 18, 2021, the record date, will be entitled to notice of the annual meeting and entitled to vote at the 2021 Annual Meeting. Each share of Class A common stock entitles its holder to one vote. Each share of Class B common stock entitles its holder to 36.5 votes.

2023 Annual Meeting

| Date and Time |  | Place via Live Audio Webcast | ||||||||||

at 11:00 a.m., Eastern Time | https://web.lumiagm.com/286413441; passcode: digitalbridge2023 (unique 11-digit control number required) | ||||||||||||

| Voting |  | Technical Support for the 2023 Annual Meeting | ||||||||||

| Only holders of record of the Company’s Class A common stock, $0.04 par value per share (“Class A common stock”) and Class B common stock, $0.04 par value per share (“Class B common stock,” and together with Class A common stock, our “common stock”), as of the close of business on March 15, 2023, the record date, will be entitled to notice of and to vote at the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”). Each share of Class A common stock entitles its holder to one vote. Each share of Class B common stock entitles its holder to 36.5 votes. | If you have difficulty accessing the virtual 2023 Annual Meeting, technicians will be available to assist you via the following toll free phone number (800) 937-5449. | ||||||||||||

DIGITALBRIDGE 2023 PROXY STATEMENT | 1

PROXY SUMMARY

Proposals and Board Recommendations

| Proposal | Board Recommendation | For More Information | ||

| 1 | To elect 9 directors nominated by our Board of Directors to serve until the 2024 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified |  | FOR each of the nominees listed on the enclosed proxy card | Page |

| 2 | To |  | FOR | Page |

| 3 | To recommend, on a non-binding, advisory basis, the frequency of the advisory vote on named executive officer compensation |  | ONE YEAR | Page 71 |

| 4 | To consider and vote upon an amendment to our articles of amendment and restatement, as amended and supplemented (“Charter”), to decrease the number of authorized shares of common stock |  | FOR | Page 72 |

| 5 | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, |  | FOR | Page 74 |

How to Cast Your Vote

We have provided you with three different methods for you to vote your proxy. Please see the enclosed proxy card or voting instruction form for additional details regarding each voting method.

| By Internet | By Telephone | By Mail | |||||||||||||||

|  |  | |||||||||||||||

|  |  | |||||||||||||||

| Vote 24/7 | Dial toll-free to vote 24/7 | Cast your ballot, sign your proxy | |||||||||||||||

| card and send by pre-paid mail | |||||||||||||||||

2022 Year in Review

Despite a dynamic macro environment, DigitalBridge delivered solid growth in revenue and earnings in 2022, maintaining its position as the partner of choice to top management teams and institutional investors allocating capital to the durable digital infrastructure asset class. Today, with over $65 billion in assets under management (“AUM”), DigitalBridge has established itself as a preeminent investor in a sector benefiting from strong secular tailwinds.

Established the Asset Management Platform as Our Strategic Growth Driver

| ■ | ||

| Oriented DBRG around a scalable, asset-light business model that represents an alternative approach to invest in the digital infrastructure ecosystem. | ||

| ■ | ||||||||

| Executed a series of transactions to reinforce this roadmap including (i) the repurchase and consolidation of 100% ownership of our investment management business and (ii) the acquisition of AMP Capital’s | ||||||||

2 |DIGITALBRIDGE 2023 PROXY STATEMENT

PROXY SUMMARY

infrastructure equity business (now rebranded InfraBridge) to add a mid-market capability to our digital rotation. With Colony’s global scalefranchise and operating platform, and the foundational work implemented in 2020, we believe we are well positioned to capitalize on the powerful secular tailwinds supporting the continued growth and investment in digital infrastructure.

| ■ | ||

| Initiated the first stage of a planned deconsolidation of the Operating segment with the DataBank recapitalization process, generating $425 million in proceeds to the Company, reflecting a 2.0x multiple of invested capital since our initial investment in DataBank in December 2019, and aligning the Company’s balance sheet more closely with the asset management business model. | ||

Scaled AUM with New Capital Formation That Exceeded Targets

| ■ | Cumulative organic fundraising of $8.5 billion, including $4.8 billion in new third party fee earning equity under management (“FEEUM”), which exceeded the midpoint of the FEEUM guidance by 26%. |

| ■ | Grew FEEUM to $27.8 billion as of the last reported earnings release date, up 52% since the end of 2021, with contributions from new core and credit strategies, co-invest, and the AMP (InfraBridge) acquisition. |

| ■ | Successful launch of new core and credit strategies and AMP (InfraBridge) acquisition advanced “Full Stack” profile, positioning DBRG as the leading investor across the sector. |

Executed Accretive Capital Allocation While Maintaining Strong Liquidity

| ■ | Four accretive transactions allocated over $900 million in cash to M&A and capital structure optimization, which we expect to drive an increase in annual run-rate earnings of $85 million, an increase in earnings per share of $0.49/share. |

| ■ | Despite significant capital deployment, DigitalBridge prioritized and maintained strong liquidity, which stood at $680 million as of the last reported earnings release date. |

| ■ | Management continued to de-lever the business, reducing both investment level and corporate debt on a pro-rata basis from $1.4 billion to $1.1 billion, a reduction of over 20%. |

| ■ | Established a “low but grow” dividend ($0.01/quarter) for the first time since the transition to DigitalBridge. |

Strong Portfolio-Level Performance Drove Great Outcomes

| ■ | ||||||||

| Despite rising rates and an inflationary environment, DigitalBridge generated successful realizations from Wildstone (DBP I) and Vantage Towers (DBP II), and the DataBank recapitalization, which generated $32.6 million of carried interest on a cumulative basis for DBRG shareholders. All three transactions were executed well in excess of their carrying values. | ||||||||

Stockholder Engagement Our | |||||

| DIRECTOR | INDEPENDENCE | STANDING COMMITTEE MEMBERSHIPS(2) | |||||||||||||||||||||

| NAME | AGE | SINCE | STATUS(1) | OCCUPATION | AC | CC | NG | ||||||||||||||||

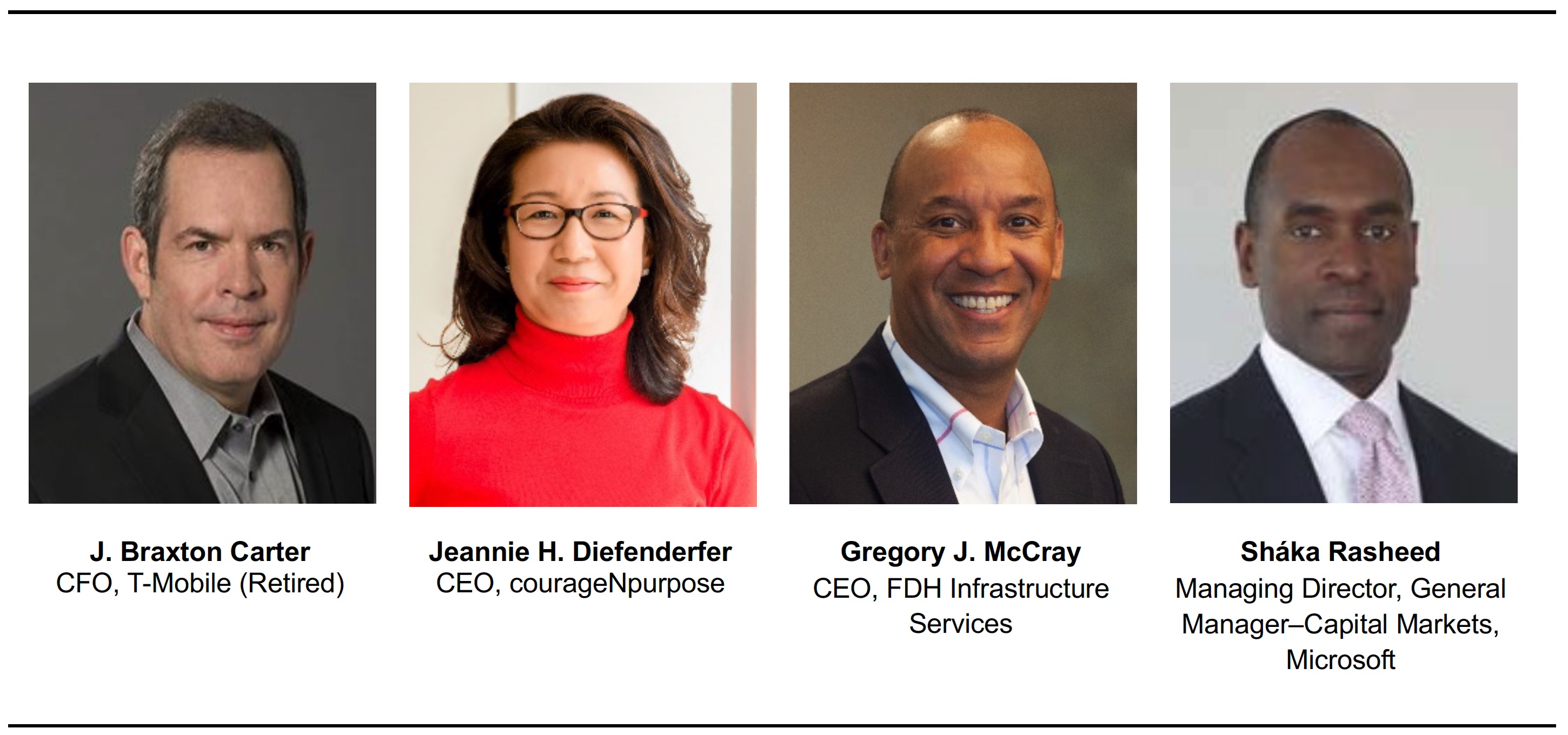

| Sháka Rasheed | 49 | n/a | Yes | Managing Director, General Manager - Capital Markets at Microsoft | — | — | — | ||||||||||||||||

| J. Braxton Carter | 62 | 2021 | Yes | Former Chief Financial Officer, T-Mobile US, Inc. (NASDAQ: TMUS) | C, E | M | — | ||||||||||||||||

| Gregory J. McCray | 58 | 2021 | Yes | CEO, FDH Infrastructure Services | — | M | M | ||||||||||||||||

| Jeannie H. Diefenderfer | 60 | 2020 | Yes | Founder/CEO of courageNpurpose, LLC | M | — | M | ||||||||||||||||

| Marc C. Ganzi | 49 | 2020 | No (Employed by the Company) | CEO & President of CLNY | — | — | — | ||||||||||||||||

| Dale Anne Reiss | 73 | 2019 | Yes | Global and Americas Director of Real Estate, Hospitality and Construction, Ernst & Young LLP (retired) | M, E | — | C | ||||||||||||||||

| Jon A. Fosheim | 70 | 2017 | Yes | Former CEO of Oak Hill REIT Management | M, E | C | — | ||||||||||||||||

Nancy A. Curtin(3) | 63 | 2014 | Yes | CIO and Head of Investment Advisory of Alvarium Investments | — | — | — | ||||||||||||||||

| Thomas J. Barrack, Jr. | 73 | 2009 | No (Employed by the Company)(4) | Executive Chairman of CLNY(4) | — | — | — | ||||||||||||||||

| John L. Steffens | 79 | 2009 | Yes | Founder of Spring Mountain Capital, LP | — | M | M | ||||||||||||||||

Following outreach with stockholders representing more than 50% of our outstanding shares during February 2021, the ChairCompany implemented meaningful changes to the Company’s executive compensation program and enhanced transparency around certain compensation matters in the Company’s proxy statement. In subsequent stockholder outreach campaigns in 2021 and 2022, we received positive feedback regarding the implementation and continuation of our Compensation Committee (John L. Steffens) met with nine of our top 15 stockholders, representing approximately 35% of our outstanding shares.these changes. Neither our Executive Chairman, Chief Executive Officer, nor any other named executive officer, participated in any of these meetings with stockholders. Allstockholders, and all of the feedback received was shared with the full Board of Directors.

DIGITALBRIDGE 2023 PROXY STATEMENT |3

PROXY SUMMARY

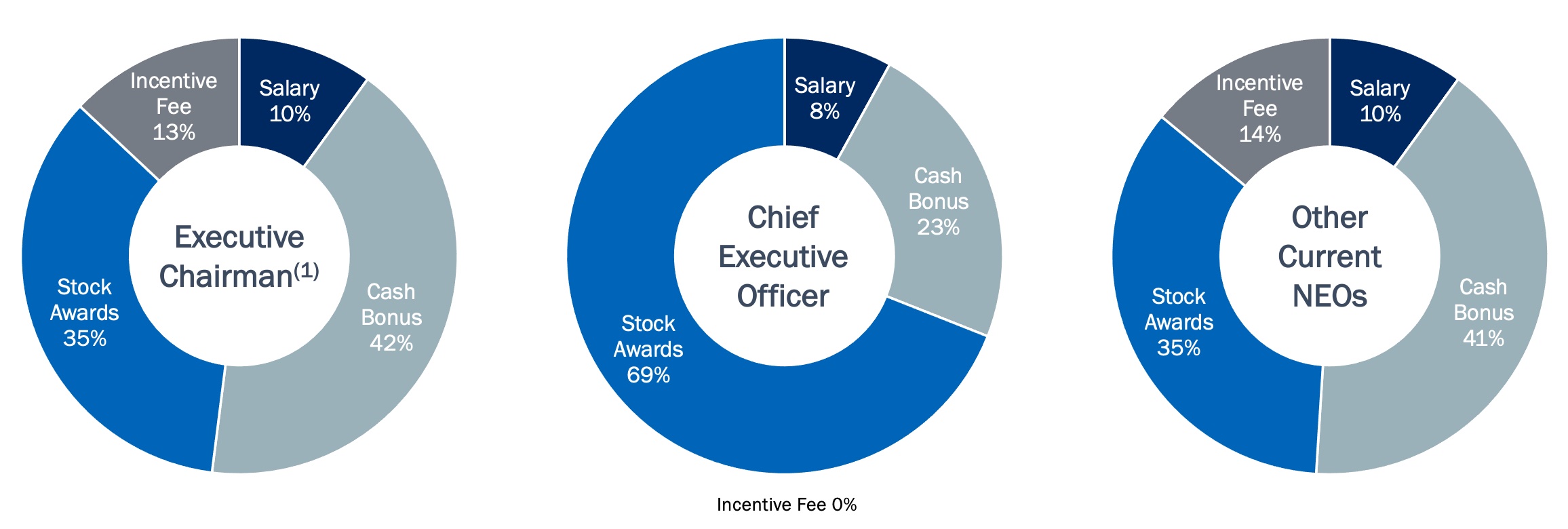

We strongly consideredconsider the feedback received on our executive compensation programresponses we receive from stockholders in implementing our executive compensation program for 2021.

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

For further information, see “Executive Compensation Highlights” below.

Commitment to Environmental, Social & GOVERNMENTALGovernmental (ESG) INITIATIVES

Overview—ESG at DigitalBridge

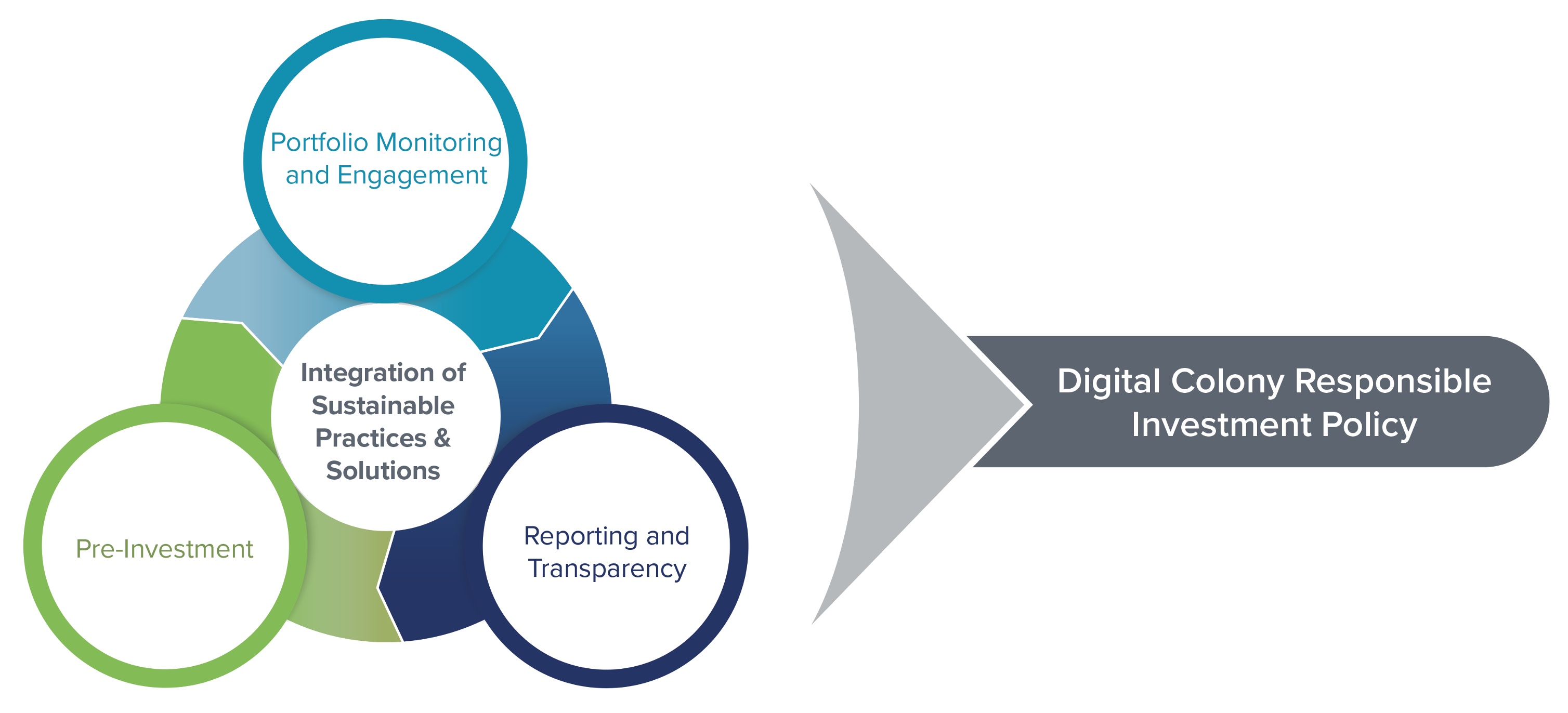

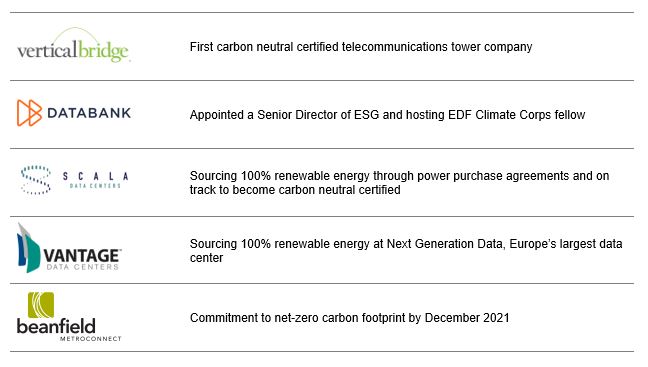

The Board of Directors at DigitalBridge provides ultimate oversight of our 28 year history, Colony has had a long standing commitment to integrating environmental, social and governance principles throughout its(“ESG”) program. Our Nominating and Corporate Governance Committee is responsible for implementing and monitoring our ESG program. As we continue to expand our business, boththis oversight is critical to ensuring that our implementation of ESG goals and policies progresses as planned and our strategy evolves appropriately. During 2022, we made significant progress in implementing our ESG strategy, progressing on related goals and continuing to build organizational capacity to effect change. The core components of our program include:

Governance: Implementation of our ESG strategy and initiatives is led by our ESG Committee, which reports to the Board on a quarterly basis. The ESG Committee is comprised of 10 diverse professionals, including members of senior management, that work across the Company’s activities. The ESG Committee is responsible for setting the strategic plan for ESG initiatives across the Company and works with portfolio companies to assist them in developing and implementing their ESG plans. For purposes of our ESG program, we define a portfolio company as any company in which one of the Company’s private funds (i) owns a majority stake, (ii) has invested at least $100 million and (iii) has been held for at least two years.

Responsible Investment Policy: ESG Integration, including management of climate-related risks and opportunities, is guided by our Responsible Investment Policy. DigitalBridge is a proud signatory of the firm/corporate levelPrinciples for Responsible Investment (“PRI”) because we recognize the value of supporting a nonprofit organization that advances responsible investment globally, shares best practices across the industry, and across its ownedprovides an assessment and managed investments. In connection withpeer benchmarking of our performance.

Due Diligence Procedures: We have integrated ESG analyses into the due diligence of our digital transformation, we seekequity fund investments and our ESG analysis is presented to improve the operating performance of both ourrelevant fund Investment Committee for each portfolio company and the digital companies in whichthat we invest by helpingin.

Asset Management: We have developed an ESG reporting framework for DigitalBridge portfolio companies, identifying nine ESG-related expectations as well as a set of ESG key performance indicators (“KPIs”) that we expect to sustainably connectbe measured and reported quarterly to the world’s leading mobile communicationsportfolio company board as well as to DigitalBridge’s ESG team. We typically hold calls with portfolio company ESG leadership every two months and technologyhave built a central repository of key documents and tools that all of our portfolio companies can access and leverage to further develop their ESG programs.

Transparency: The Company issues an annual ESG Report, which is available on our website, to provide transparent communication around our ESG efforts. We published our 2021 ESG report in June 2022 detailing measurable progress at both the Company and our portfolio companies. Our 2022 ESG Report will be released this spring. The information that is found on or accessible through our website is not

4 |DIGITALBRIDGE 2023 PROXY STATEMENT

PROXY SUMMARY

incorporated into, and does not form a part of, this proxy statement or any other report or document that we file with enterprisesor furnish to the Securities and consumers atExchange Commission (“SEC”).

DEI: Under our Diversity, Equity and Inclusion (“DEI”) initiative, which consists of four pillars (mentorships, internships, recruitment and careers and compensation), we will continue to ensure we have a workplace where people from all backgrounds can thrive. To accomplish the lowest possible costcompany’s DEI goals, the ESG Committee collaborates with the lowest possible carbon footprint.

Board Training: We invest in developing the Board’s understanding of ESG matters. We provided ESG updates regarding our companyprogress as well as pertinent ESG trends in the financial sector to our Board members during 2022. Briefings also covered climate-related risks and opportunities, including the nexus of climate change and digital infrastructure as well as the science and evolving certification schemes associated with achieving net zero greenhouse gas emissions.

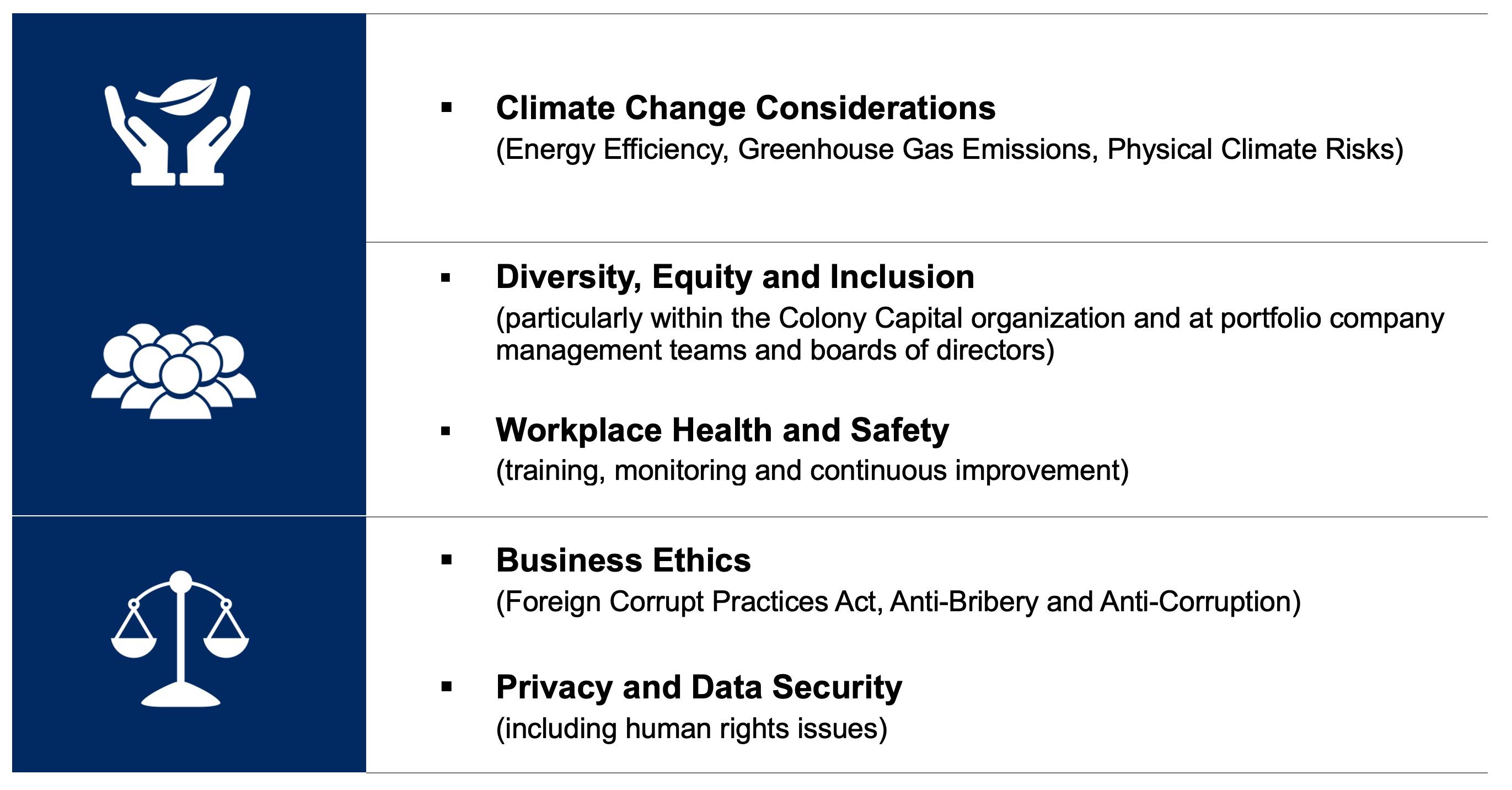

Our Approach to ESG Integration

ESG PRIORITIES

We have developed a thorough approach to addressing ESG matters across ourthe investment portfolio, we strategically focus on ourlife cycle and have identified the following as the most material ESG issues. Through a materiality mapping process,items that we identified a host of relevant ESG issuesconsider during due diligence and then prioritize themactively monitor during asset management.

| 1. | Climate Change: Energy Efficiency, Greenhouse Gas (“GHG”) Emissions, and Physical Climate Risks |

| 2. | Data Privacy, Data Security, and Associated Human Rights |

| 3. | Diversity, Equity, and Inclusion |

| 4. | Ethics: Foreign Corrupt Practices Act, Anti-Bribery, and Anti-Corruption |

| 5. | Employee Wellbeing: Workplace Health and Safety |

These matters were selected according to two criteria: those that have the greatest impacteffect on our business and those that are the most important to our stakeholders. As a result of this process, weOur materiality assessment was informed by relevant leading global reporting frameworks including the Sustainability Accounting Standards Board, Principles for Responsible Investment and the Task Force on Climate-Related Financial Disclosures.

ESG EXPECTATIONS FOR PORTFOLIO COMPANIES

DigitalBridge sets high ESG expectations, shares best practices and equips each portfolio company with tools and resources to help them accelerate their ESG initiatives. We have identified the following five core ESG issues, onfoundational practices, which we will focus our efforts.

| ■ | ||

| ESG Policy and Responsibility: Each portfolio company is asked to develop an ESG policy tailored to its business and assign ESG management to specific individual(s) at the company. Larger companies may also have an ESG Committee or working group. | ||

| ■ | Net Zero: Each portfolio company is expected to complete its GHG footprint each year and have a Net Zero strategy roadmap approved by its board of directors. |

| ■ | ESG Board Reporting: Each portfolio company’s quarterly board report is expected to include an ESG section. |

| ■ | ESG Responsibility (Whistleblower Hotline): Each portfolio company is expected to have a hotline for all stakeholders to report concerns, and call logs should be made available to its board. |

DIGITALBRIDGE 2023 PROXY STATEMENT |5

PROXY SUMMARY

| ■ | Training: Each portfolio company is expected have regular trainings that reach all employees on topics including employee safety, diversity and inclusion, unconscious bias, climate change, discrimination, harassment and anti-bribery/Foreign Corrupt Practices Act (“FCPA”). |

| ■ | Human Resources Audit: Each portfolio company is expected to conduct human resources compliance reviews and/or audits with outside resources to ensure compliance with all relevant regulations. |

| ■ | Diversity and Inclusion: Each portfolio company is expected to have a diversity and inclusion program with policies and procedures to ensure a diverse and inclusive work environment. |

| ■ | ESG Event Reporting: Each portfolio company is expected to have a process in place to ensure that material ESG events (such as sexual harassment, serious workplace accidents, FCPA violations, cyberattacks or similar large network outages, employment violations, product recalls, furloughs, regulatory investigations, or lawsuits) are reported at the board level within 48 hours. |

| ■ | Corporate Citizenship: Each portfolio company is asked to have a formal corporate citizenship/philanthropic program that has executive-level sponsorship and oversight. |

NET ZERO 2030

One of our investmenthighest priorities at DigitalBridge remains reaching net zero GHG emissions. We measure this goal using the definition of net zero provided by the Science Based Targets Initiative (“SBTi”). We believe that our net zero goal is important to our business given our global strategic relationships with hyperscale data center providers, large mobile network operators and value-creation process. The Responsible Investment Policy of Digital Colony, Colony Capital’s global digital infrastructure investment arm, details its visionother customers with aggressive decarbonization commitments. We continue to build a sustainable futuretarget the Company reaching net zero by creating economic value, preserving resources,2030.

In 2022 and improving the communities in whichearly 2023, we revised our organization operates. Digital Colony has developed a thorough approach to integrating the most material ESG issues across each phase of the investment life cycle.

We plan to establishcontinue supporting portfolio companies in GHG emissions measurement, renewable energy procurement, emission reduction strategies and roadmaps and will strive to ensure that portfolio companies are prioritizing resource efficiency, renewable power purchasing and value chain engagement before balancing unavoidable emissions with high integrity carbon removals.

By following best practices and consulting with industry experts, we believe that encourage respect for human rights, Board-level transparency,we have developed goals that are comprehensive, credible, clear and stakeholder communication, as listed below.

| 1. | Comprehensive: We consider Scope 1, 2 and all significant Scope 3 GHG emissions at DigitalBridge. |

| 2. | Credible: Our goal for DigitalBridge aligns with the current SBTi definition of net zero. |

| 3. | Clear: We utilize the Task Force on Climate-Related Financial Disclosures framework to measure and report on progress in our annual ESG report. |

| 4. | Achievable: We believe that the goals we set for the Company and our portfolio companies are achievable using the framework described above. |

6 |DIGITALBRIDGE 2023 PROXY STATEMENT

PROXY SUMMARY

| 2022 Progress | ||||

| Governance | ■ Enhanced portfolio company ESG | |||

| ■ Increased our support and resources available to portfolio companies on ESG issues | ||||

| Climate Change | ■ Updated our Net Zero strategy to align with the changing requirements of SBTi | |||

| ■ Advised our portfolio companies on adjusting their climate roadmaps in light of changed SBTi requirements and continued supporting their work in advancing their climate strategies | ||||

| ■ Reported our climate-related risk management approach informed by guidance from the Task Force on Climate-Related Financial Disclosure for the second year | ||||

| Diversity, Equity and Inclusion | ■ Adopted and communicated a DEI Policy identifying four focus areas and ten supporting commitments, with input from our employees and broader stakeholders | |||

| ■ Our Chief Executive Officer signed the CEO Action for Diversity and Inclusion Pledge | ||||

| ■ 90% of our Summer Internship Program participants were from groups historically underrepresented in finance | ||||

| ■ 45% of new full-time employees hired in 2022 were female | ||||

| Transparency | ■ Issued our second ESG | |||

| ■ More than one third of DigitalBridge portfolio companies have now published ESG reports or websites | ||||

| Human | ||||

| ■ Launched our Inaugural Analyst Program with four analysts—all sourced from our Summer Internship Program | ||||

| ■ Created a Careers and Compensation panel to attract and retain talent, including those from groups historically underrepresented in finance | ||||

| ■ Increased guidance in our talent management software and learning solution | ||||

| ■ Launched our first Employee Resource Group, a book club focused on fostering a better understanding of diversity, equity and inclusion | ||||

DIGITALBRIDGE 2023 PROXY STATEMENT |7

PROXY SUMMARY

Corporate Governance Highlights

| ✓ | No classified board(1) | ✓ | Opted out of MUTA(1) | |

| ✓ | Majority voting standard for election of directors | ✓ | Favorable stockholder rights(2) | |

| ✓ | Anti-hedging/pledging policy | ✓ | Stock ownership guidelines for directors and officers |

| (1) | ||

| Stockholder approval required for DBRG board to adopt a classified board structure and other anti-takeover provisions. | ||

| (2) | ||||||||

| DBRG stockholders have the ability to call special stockholders meetings, remove and replace directors, amend bylaws and approve increases in the number of shares authorized for issuance. | ||||||||

8 |DIGITALBRIDGE 2023 PROXY STATEMENT

PROPOSAL NO. 1: Election of Directors

ELECTION OF DIRECTORS

Based on the recommendation of the Nominating and Corporate Governance Committee, the Board has unanimously recommended that the following 109 persons be elected to serve on our Board, each until the 2022 annual meeting2024 Annual Meeting of stockholdersStockholders and until his or her successor is duly elected and qualified: Thomas J. Barrack, Jr., J. Braxton Carter, Nancy A. Curtin, Jeannie H. Diefenderfer, Jon A. Fosheim, Marc C. Ganzi, Gregory J. McCray, Sháka Rasheed, Dale Anne Reiss and John L. Steffens.

| ■ James Keith Brown | ■ Nancy A. Curtin | ■ Jeannie H. Diefenderfer | ||

| ■ Jon A. Fosheim | ■ Marc C. Ganzi | ■ Gregory J. McCray | ||

| ■ Sháka Rasheed | ■ Dale Anne Reiss | ■ David M. Tolley | ||

Other than Mr. Brown, who is a third party executive search firm and consultant, to assist us in evaluating Board composition, governance and refreshment matters, with a focusnominee that does not currently serve on identifying potential director candidates with appropriate digital experience to join our Board as we continue to execute on our digital evolution. As a result of this evaluation, our Board is not only reducing the size of the Board, to 10 members (from 12 members) at the 2021 Annual Meeting, but has also nominated four independent directors (three of whom are incumbent directors) to the Board who have substantial experience in the digital, telecommunications and technology industries.

Each nominee has consented to being named in this Proxy Statement and to serve if elected. If, prior to the 20212023 Annual Meeting, a nominee is not able to serve for any reason or for good cause will not serve, proxies will be voted for an additional person designated by our Board, unless our Board determines to reduce the number of directors or to leave a vacant seat on our Board in accordance with the Company’s charter and bylaws.

| ||

| Our Board of Directors Recommends a Vote “FOR” the Election of Each of the Nominees Identified Above and Nominated by our Board of Directors. | ||

DIGITALBRIDGE 2023 PROXY STATEMENT

Our Board of Directors believes that having a diverse mix of directors with complementary qualifications, expertise, and attributes is essential to meeting its oversight responsibility. All of our directors except Thomas J. Barrack, Jr., our Executive Chairman, and Marc C. Ganzi, our Chief Executive Officer, and President, are independent. Each of our directors attended at least 75% of the aggregate number of meetings held by: (i) the Board of Directors during such director’s respective term of service in 2020;2022; and (ii) each committee, in each case during the period in 20202022 for which such director served as a member.

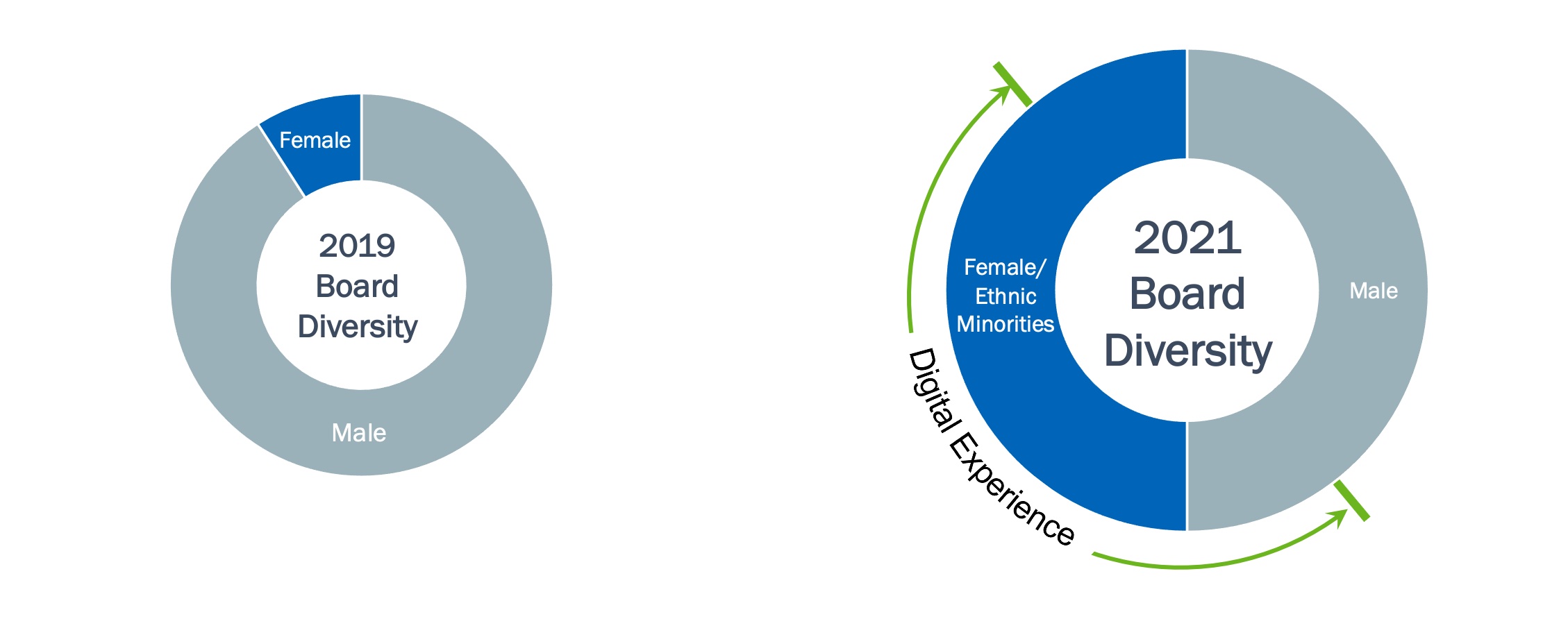

Our Board also recognizes the importance of refreshment, particularly in light of the Company’s ongoingrecently completed digital transformation. In 2020,2022, we engaged Spencer Stuart, a third partyan executive search firm, and consultant, to assist us in evaluating Board composition, governance and refreshment matters, including engaging in a robust searchtwo searches to identify potentialfind two new Board candidates with digitalinvestment management experience and that would qualify as independent. Spencer Stuart identified David M. Tolley, who will be independentwas appointed to join the Board. As a result, during 2020 to date,Board in August 2022, and James Keith Brown, who is nominated for election at the 2023 Annual Meeting. In addition, the Board has taken actionsmaintained its digital expertise, with five members having digital infrastructure and communications experience (four of such director nominees being independent).

Nominees for DigitalBridge Board of Directors—At-A-Glance

10 |DIGITALBRIDGE 2023 PROXY STATEMENT

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Board Composition and Refreshment

Our Board recognizes the importance of having the right mix of skills, expertise and experience and is committed to effect the following enhancementscontinuously reviewing its capabilities in relation to our strategic direction and ongoing refreshment. In keeping with this commitment, our Board governance and refreshment:

Our Nominating and Corporate Governance Committee has prioritized diversity in its refreshment over the past several years. As a result, our 9 director nominees for the 2023 Annual Meeting include three standing committees)

The table below summarizes the key experience, qualifications and attributes for each director nominee and highlights the balanced mix of experience, qualifications and attributes of the Board as a whole. This high-level summary is not intended to be an exhaustive list of Directorseach director nominee’s skills or contributions to our independent, non-executive Chairperson of the Board of Directors.

| Brown | Curtin | Diefenderfer | Fosheim | Ganzi | McCray | Rasheed | Reiss | Tolley | |||

| CEO/Executive Leadership | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ||

| Qualified Financial Expert | ■ | ■ | ■ | |||||||

| Digital | ■ | ■ | ■ | ■ | ■ | |||||

| Capital Markets | ■ | ■ | ■ | ■ | ■ | ■ | ■ | |||

| Investment/ Portfolio Management | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ||

| Risk Management | ■ | ■ | ■ | ■ | ■ | ■ | ■ | |||

| Legal/Regulatory | ■ | ■ | ■ | ■ |

DIGITALBRIDGE 2023 PROXY STATEMENT |11

PROPOSAL NO. 1: Election of DirectorsELECTION OF DIRECTORS

| Brown | Curtin | Diefenderfer | Fosheim | Ganzi | McCray | Rasheed | Reiss | Tolley | |||

| Strategic Transformation | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ||

| Human Capital | ■ | ■ | ■ | ■ | ■ | ■ | ■ | |||

| Corporate Governance | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ |

Our Director Nominees

The information below includes each director nominee’s name, age, principal occupation, business history and certain other information, including the specific experience, qualifications, attributes and skills that led our Board to conclude that each such person should serve as a director of our company.

| JAMES KEITH BROWN | ||||

Independent Director Nominee Independent Director Nominee | |||||

Former Senior Managing Director AGE 60 | EXPERIENCE ■ Senior Managing Director of Coatue Management LLC from ■ Executive Managing Director & Head, Global Investor Relations of ■ Managing Director & Head, U.S. Institutional Sales & Relationship Management of Goldman, Sachs & Co. from 1999 to 2003 ■ Managing Director, Global Asset & Investment Management, Consulting and VP, Global Asset Management, Bankers Trust Company from 1992 to 1999 ■ Regional Director, Foundation & Corporate Relations at Dartmouth College from 1991 to 1992 ■J.P. Morgan & Co. from 1985 to 1990 QUALIFICATIONS, ATTRIBUTES AND SKILLS ■ Over 25 years of investment management experience, including senior leadership roles in capital raising | ■ Well-versed in engaging with private fund investors around the world and brings deep experience in product design and strategy OTHER POSITIONS/RECOGNITIONS ■ Board member and member of co-investment committee of UNC Investment Fund (2018 to present) ■ Served as the Chair of the Operating Committee at Coatue Management LLC ■ Served on the Management Committee of Och Ziff (now Sculptor Capital Management) (NYSE: SCU) for a decade and ran Best Practice Committee for the firm ■ Chair of Executive Committee at the Lincoln Center (10 years) ■ President of the Board of the New Museum (10 years and on the board for 24 years) and served on investment, finance and audit committees, among others ■ Served on board member of Andy Warhol Foundation (Chair of Finance and on Investment and Audit Committees) EDUCATION ■ Bachelor of Arts with Honors, University of North Carolina | |||

12 |DIGITALBRIDGE 2023 PROXY STATEMENT

PROPOSAL NO. 1: ELECTION OF DIRECTORS

| NANCY A. CURTIN |  Independent Director since 2014 Independent Director since 2014 | |||

Chief Investment Officer of Alvarium Tiedemann Holdings, Inc. AGE 65 ■ Chairperson of the Board | EXPERIENCE ■ Chief Investment Officer and Board Director of ■ Partner, Group Chief Investment Officer, Head of Investment Advisory and participant member of the Supervisory Board of Alvarium Investments from May 2020 through the business combination of Alvarium Investments with Tiedemann Wealth Management Holdings, LLC and certain other parties in January 2023 ■ Chief Investment Officer and Head of Investments of Close Brothers Asset Management (CBAM), a UK investment and financial advice firm focused on private clients, high-net-worth, charities, and family offices, from 2010 to ■ Chief Investment Officer and Managing Partner of ■ Managing Director of Schroders Plc and Head of Global Investments for the Mutual Funds business & founded Internet Finance Partners, a venture arm of Schroders. ■ Head of Emerging Markets at Baring Asset Management; Board member for Baring Venture Partners, Member of Global Senior ■ Co-Head of ■ Early career, M&A and Corporate Finance at QUALIFICATIONS, ATTRIBUTES AND SKILLS ■ Over 25 years of | ■ Proven business builder of global investment and wealth management businesses with C-suite and board responsibility driving significant AUM growth at attractive operating margins ■ Successful track record of CIO execution; leading large investment teams in pursuit of institutional quality investment disciplines to deliver superior investment performance ■ Deep understanding of regulatory environment for investment management, with proven ability to institute best practice front line controls, oversight, and governance OTHER BOARDS ■ Right to Play, global education charity helping over 2.3 million children each year in war torn countries and areas of significant dislocation EDUCATION ■Bachelor of Arts, ■Master of Business Administration, Harvard Business School ■ 2019: Harvard Business School Executive Education, Woman on Boards Certificate ■ Harvard Business School, Corporate Director Certification (accepted into programme, expected completion Q4 2023): ■ Audit Committees in a New Era of Governance-Completed ■ Compensation Committees: New Challenges, New Solutions-November 2023 ■ Making Corporate Boards More Effective-November 2023 | ||

DIGITALBRIDGE 2023 PROXY STATEMENT

|13

PROPOSAL NO. 1: Election of DirectorsELECTION OF DIRECTORS

| JEANNIE H. DIEFENDERFER | |||||||

Independent Director since Independent Director since | |||||||

Founder and Chief Executive Officer of courageNpurpose, LLC AGE 62 COMMITTEE MEMBERSHIPS ■ Compensation Committee ■ Nominating & Corporate Governance Committee | |||||

| EXPERIENCE ■Founder and Chief Executive Officer of courageNpurpose, LLC since 2014 ■Executive leadership positions at Verizon Communications, including leading Verizon’s global customer care organization for its largest enterprise customers from 2010 to 2012, serving as Senior Vice President of Global Engineering & Planning from 2008 to 2010, and as Chief Procurement Officer from 2005 to 2008 QUALIFICATIONS, ATTRIBUTES AND SKILLS ■Ms. Diefenderfer’s substantial technical and operational experience in the telecommunications industry, as well as her senior executive positions and service on public and advisory boards, will provide the Board with valuable insight as the Company continues to implement its strategic transition, as well as guidance on corporate governance matters and complex business issues OTHER PUBLIC COMPANY BOARD EXPERIENCE ■Windstream Holdings, Inc. (formerly NASDAQ:WINMQ) (February 2016 to September 2020) | ■MRV Communications, Inc. (formerly NASDAQ:MRVC) (July 2014 to August 2017) ■Westell Technologies, Inc. (OTC WSTL) (September 2015 to September 2017) OTHER POSITIONS/RECOGNITIONS ■ CEO of Center for Higher Ambition Leadership since June 2021 ■2020 National Association of Corporate Directors (NACD) Directorship 100 list honoree ■ Independent board member of Irth Solutions since March 2022 ■ Trustee of ■Board Member of NACD NJ Chapter ■Vice Chair of the Board, Women in America EDUCATION ■Bachelor of Science, Tufts University ■Master of Business Administration, Babson College | |||||

| JON A. FOSHEIM |  Independent Director since 2017 Independent Director since 2017 | |||

Chief Executive Officer of AGE 72 COMMITTEE MEMBERSHIPS ■ Audit Committee ■ Compensation Committee (Chair) | EXPERIENCE ■ Chief Executive Officer of Oak Hill REIT Management, LLC from 2005 until his retirement in 2011 ■ Principal and Co-founder of Green Street Advisors, a REIT advisory and consulting firm, from 1985 to 2005 QUALIFICATIONS, ATTRIBUTES AND SKILLS ■ Extensive investment management and senior leadership experience ■ Expertise in financial analysis and accounting matters OTHER PUBLIC COMPANY BOARD EXPERIENCE ■ Apple Hospitality REIT, Inc. (NYSE: APLE) (January 2015 to present; Member of Audit Committee and Corporate Governance Committee) ■ Associated Estates Realty Corporation (formerly NYSE: AEC) (February 2015 to August 2015) | OTHER POSITIONS/RECOGNITIONS ■ Director and Chairman of the Audit Committee of the Arnold and Mabel Beckman Foundation ■ 2003 Recipient of the National Association of Real Estate Investment Trusts (NAREIT) Industry Achievement Award ■ Previously worked in institutional sales at Bear Stearns & Co. and the tax department at Touche Ross and Co. (now Deloitte & Touche LLP LLP) EDUCATION ■ Bachelor of Arts, University of South Dakota ■ Master of Business Administration and Juris Doctor, University of South Dakota | ||||

14 |DIGITALBRIDGE 2023 PROXY STATEMENT

PROPOSAL NO. 1: ELECTION OF DIRECTORS

| MARC C. GANZI | Director since 2020 | |||

Chief Executive Officer of DigitalBridge AGE 51 | EXPERIENCE ■Founded and served as Chief Executive Officer of Digital Bridge Holdings (“DBH”), ■Founded Global Tower Partners (“GTP”), which grew to become one of the largest privately-owned tower companies in the U.S. under his leadership before being acquired by American Tower Corporation in 2013 ■Consulting partner for DB Capital Partners from 2000 to 2002 where he oversaw the institution’s investments in the Latin American tower sector ■Co-founded and served as President of Apex Site Management, one of the largest third-party managers of wireless and wireline communication sites in the United States. QUALIFICATIONS, ATTRIBUTES AND SKILLS ■Leading visionary and entrepreneur, with decades of investment experience in the digital infrastructure and telecommunications market, ■Extensive experience as a founder and Chief Executive Officer of several digital companies, including DBH | OTHER POSITIONS/RECOGNITIONS ■Member of boards of corporations, including: ■Assistant Commercial Attaché in Madrid for the U.S. Department of Commerce’s Foreign Commercial Service Department in 1990 ■Presidential Intern in the White House for the George H.W. Bush administration with the Office of Special Activities and Initiatives for the Honorable Stephen M. Studdert in 1989 ■Board Member of the Wireless Infrastructure Association from 2008 to 2017 and served as Chairman from 2009 to 2011 ■ Member of Nareit 2022 Advisory Board of Governors, Member of the Young Presidents’ Organization, the Broadband Deployment Advisory Committee of the Federal Communications Commission, and EDUCATION ■Bachelor of Science, Wharton School of Business | ||

DIGITALBRIDGE 2023 PROXY STATEMENT

|15

PROPOSAL NO. 1: Election of DirectorsELECTION OF DIRECTORS

| GREGORY J. MCCRAY |  Independent Director since 2021 Independent Director since 2021 | ||||||

Chief Executive Officer of FDH Infrastructure Services AGE 60 COMMITTEE MEMBERSHIPS ■ Nominating & Corporate Governance Committee ■ Compensation Committee | EXPERIENCE ■ Chief Executive Officer of FDH Infrastructure Services since June 2018 ■ Chief Executive Officer of Access/Google Fiber in 2017 ■ Chief Executive Officer of Aero Communications Inc., which provides installation, services and support to the communications industry, from 2013 to 2016 ■ Chief Executive Officer of Antenova, a developer of antennas and radio frequency modules for mobile devices, from 2003 to 2012 ■ Chairman and Chief Executive Officer of PipingHot Networks, which brought broadband fixed wireless access equipment to market, from 2001 to 2002 ■ Senior Vice President of customer operations at Lucent Technologies from 1996 to 2000 QUALIFICATIONS, ATTRIBUTES AND SKILLS ■ Extensive executive experience with 30 years of business, marketing, sales, engineering, operations, mergers and acquisitions, management and international experience in the communications technology industry | ■ Experience as a current and former director at other public companies, which enables him to provide significant insight as to governance and risk-related matters OTHER PUBLIC COMPANY BOARD EXPERIENCE ■ Belden Inc. (NYSE: BDC) (February 2022 to present; Member of the Nominating & Corporate Governance Committee and the Finance Committee) ■ ADTRAN Inc. (NASDAQ: ADTN) (May 2017 to present; Member of the Compensation Committee and the Audit Committee) ■ Centurylink, Inc. (NYSE: CTL) (January 2005 to February 2017; Chair of the Cyber Security & Risk Committee and Member of the Compensation Committee and Nominating & Corporate Governance Committee) OTHER POSITIONS/RECOGNITIONS ■ Board Member of FreeWave Technologies (February 2020 to present) EDUCATION ■ Bachelor of Science, Iowa State University ■ Master of Science, Industrial & Systems Engineering, Purdue University ■ Executive Business Programs, University of Illinois, Harvard, and INSEAD | |||||

16 |DIGITALBRIDGE 2023 PROXY STATEMENT

PROPOSAL NO. 1: ELECTION OF DIRECTORS

| SHÁKA RASHEED |  Independent Director since 2021 Independent Director since 2021 |

SVP, Strategic Banking & Wealth Management of Salesforce, Inc. AGE 51 COMMITTEE MEMBERSHIPS ■Audit Committee ■Nominating & Corporate Governance Committee | EXPERIENCE ■SVP, Strategic Banking & Wealth Management at Salesforce, Inc. (NYSE: CRM) since September 2022 ■ Managing Director, General Manager- Capital Markets, Microsoft Corporation, where he led the US Capital Markets division from September 2019 to September 2022 ■Head of Sales & Marketing at Bridgewater Associates from December 2016 to January 2019 ■Key sales leadership, business development, management and other senior client engagement roles at: Lazard Asset Management (as Managing Director & Head of Alternative Investments—Americas, from 2013 to 2016); and Citadel Asset Management (as Acting Head, and Director of Distribution—Americas from 2010 to 2013) ■Various roles over 16 years at J.P. Morgan Chase & Co., with the last four years of his tenure at J.P. Morgan Asset Management, serving as Managing Director, Senior Client Advisor, overseeing business development QUALIFICATIONS, ATTRIBUTES AND SKILLS ■Seasoned professional with over 25 years of business development, sales, strategy, leadership and management experience at premier financial services organizations and technology companies | ■Possesses fintech acumen and deep financial services industry expertise across investment banking, debt & equity capital markets, private wealth & institutional asset management across traditional assets and alternative investments (hedge funds, private equity, and real assets) OTHER POSITIONS/RECOGNITIONS ■Former Expert Network Member at M12, Microsoft’s venture fund (2021 to 2022) ■Former Board Member, Chair of Finance Committee, The Robert Toigo Foundation (2008 to 2012) ■Founding Board Member (Brooklyn)/Board Chair (AF Endeavor) at Achievement First (2005 to 2010) ■Robert Toigo Fellow recipient (Harvard Business School) ■At Morehouse College: Oprah Winfrey full- academic scholarship recipient, a Ford Foundation Doctoral Scholar and a Woodrow Wilson Foundation Public Policy & International Affairs Fellow, and as president of the student body and a representative on Morehouse’s Board of Trustees EDUCATION ■Bachelor of Arts, Morehouse College ■Master of Business Administration, Harvard Business School |

DIGITALBRIDGE 2023 PROXY STATEMENT | 17

PROPOSAL NO. 1: ELECTION OF DIRECTORS

| DALE ANNE REISS |  Independent Director since 2019 Independent Director since 2019 |

Global and Americas Director of Real Estate, Hospitality and Construction of Ernst & Young LLP (Retired) AGE 75 COMMITTEE MEMBERSHIPS ■Audit Committee ■Nominating & Corporate Governance Committee | EXPERIENCE ■Senior Managing Director of Brock Capital Group LLC since December 2009 and Chairman of Brock Real Estate LLC since 2009 ■Senior Partner at Ernst & Young LLP and predecessor firm from ■Senior Vice President and Controller at Urban Investment & Development Company from 1980 to 1985 QUALIFICATIONS, ATTRIBUTES AND SKILLS ■Extensive expertise in financial and accounting matters from her experience over an extended period at several major public accounting firms ■Leadership experience in management and operations ■Experience as a director of other public and private companies OTHER PUBLIC COMPANY BOARD EXPERIENCE ■Tutor Perini Corporation (NYSE: TPC) (May 2014 to present; Chair of Audit Committee; Nominating and Governance Committee) ■Starwood Real Estate Income Trust, Inc. (November 2017 to present; Chair of Audit Committee) | ■iStar Inc. (NYSE: STAR) (July 2008 to May 2019; Chair of Audit Committee, Member of Nominating and Governance Committee) ■Post Properties, Inc. (formerly NYSE: PPS) (October 2008 to May 2013; Audit Committee, Nominating and Governance Committee) ■Care Capital Properties Inc. (formerly NYSE: CCP) (August 2015 to August 2017; Chair of Compensation Committee, Nominating and Governance Committee) ■CYS Investments, Inc. (formerly NYSE: CYS0 (January 2015 to July 2018; Audit Committee; Nominating and Governance Committee) OTHER POSITIONS/RECOGNITIONS ■Certified Public Accountant ■Governor and Former Trustee of Urban Land Institute (1998 to present) ■Trustee of Southwest Florida Community Foundation ■Trustee of Sanibel Police Pension Board ■Board member of Educational Housing Services (NYC) ■Trustee of Collaboratory EDUCATION ■Master of Business Administration, University of Chicago ■Bachelor of Science, Illinois Institute of Technology |

18|DIGITALBRIDGE2023 PROXY STATEMENT

PROPOSAL NO. 1: Election of DirectorsELECTION OF DIRECTORS

| DAVID M. TOLLEY | |||||

Independent Director since Independent Director since | |||||

Former EVP and Chief AGE 55 COMMITTEE MEMBERSHIPS ■Audit Committee ■Compensation Committee | EXPERIENCE ■Executive Vice President and Chief Financial Officer of Intelsat S.A. from ■ Chief Financial Officer of | |

| ■Senior Managing Director | ||||

| ■Vice President at Morgan Stanley in the QUALIFICATIONS, ATTRIBUTES AND SKILLS ■Deep understanding of | ||||

| ■Invaluable expertise on Board practices and corporate governance matters to OTHER PUBLIC COMPANY BOARD EXPERIENCE ■WeWork Inc. ■KVH Industries, Inc. (NASDAQ: KVHI) (June 2022 to present) ■Cumulus Media (NASDAQ: CMLS) (2006 to 2017) ■New Skies Satellites (2004 to ■Centennial Communications (formerly NYSE: CYCL) (2001 to OTHER POSITIONS/RECOGNITIONS ■Board of Directors of EDUCATION ■Master of ■Bachelor of | ||||||

| and History from the University of Michigan. | |||||||

DIGITALBRIDGE 2023 PROXY STATEMENT

PROPOSAL NO. 1: ElectionELECTION OF DIRECTORS

Corporate Governance

Corporate Governance Guidelines and Codes of Directors

We are committed to good corporate governance practices and, as such, we have adopted our Corporate Governance Guidelines, Code of Business Conduct and CodesEthics, and Code of Ethics for Principal Executive Officer and Senior Financial Officers discussed below to enhance our effectiveness. These guidelines and codes are available on our website at

Investor Relations Colony Capital,

DigitalBridge Group, Inc.,

750 Park of Commerce Drive

Suite 210

Boca Raton, FL 33487.

Our Corporate Governance Guidelines are designed to assist our Board in monitoring the effectiveness of decision-making at the Board and management level and ensuring adherence to good corporate governance principles, all with a goal of enhancing stockholder value over the long term. Our Corporate Governance Guidelines govern, among other things, Board member qualifications, responsibilities, restrictions and education, Board and committee function, management succession and self-evaluation. Our Code of Business Conduct and Ethics relates to the conduct of our business by our employees, officers and directors. We intendstrive to maintain high standards of ethical business practices and compliance with all laws and regulations applicable to our business, including those relating to doing business outside the United States. Specifically, among other things, our Code of Business Conduct and Ethics prohibits employees from providing gifts, favors or anything of value to government officials or employees or members of their families without prior written approval from the Company’s Deputy General Counsel - Counsel—Corporate. We have also adopted a Code of Ethics for Principal Executive Officer and Senior Financial Officers, which applies to our Chief Executive Officer, Chief Financial Officer and all other senior financial officers of our company. We will disclose any amendments or waivers from the Code of Ethics for Principal Executive Officer and Senior Financial Officers and Code of Business Conduct and Ethics on our website.

Director Independence

Of our 109 directors being nominated for election by our Board, our Board affirmatively determined that each of the following eight director nominees is independent: J. Braxton Carter, Nancy A. Curtin, Jeannie H. Diefenderfer, Jon A. Fosheim, Gregory J. McCray, Sháka Rasheed, Dale Anne Reiss and John L. Steffens are independent under the NYSE listing standards. standards:

| ■James Keith Brown | ■Nancy A. Curtin |

| ■Jeannie H. Diefenderfer | ■Jon A. Fosheim |

| ■Gregory J. McCray | ■Sháka Rasheed |

| ■Dale Anne Reiss | ■David M. Tolley |

In determining director independence, our Board considered whether or not each non-employee director or nominee has a direct or indirect material relationship with the Company and has otherwise complied with the requirements for independence under the applicable NYSE rules.

20|DIGITALBRIDGE2023 PROXY STATEMENT

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Board of Directors will include eight independent directors. In addition, effective April 1, 2021, our Executive Chairman position (currently held by Mr. Barrack) will be eliminated and Mr. Barrack will be a non-executive member of the Board. In connection with the foregoing, ourLeadership Structure

Our Board has appointed Ms. Curtin as our independent, non-executive Chairperson of the Board. As Chairperson of the Board, Ms. Curtin presides over all meetings of the Board (including executive sessions of the independent directors) and stockholders, reviews and approves meeting agendas, meeting schedules and other information, acts as a liaison between (1) the outside directors and management, including the Chief Executive Officer, (2) among independent directors and (3) between interested third parties and the Board, serves as the focal point of communication to the Board regarding management plans and initiatives, ensures that the role between Board oversight and management operations is respected, consults on stockholder engagement and governance matters and performs such other duties as the Board requires from time to time.

| ■ | presides over all meetings of the Board (including executive sessions of the independent directors) and stockholders, |

| ■ | reviews and approves meeting agendas, meeting schedules and other information, |

| ■ | acts as a liaison between |

| (1) | the outside directors and management, including the Chief Executive Officer, |

| (2) | among independent directors, and |

| (3) | between interested third parties and the Board, |

| ■ | serves as the focal point of communication to the Board regarding management plans and initiatives, |

| ■ | ensures that the role between Board oversight and management operations is respected, |

| ■ | consults on stockholder engagement and governance matters, and |

| ■ | performs such other duties as the Board requires from time to time. |

Our President and Chief Executive Officer, Mr. Ganzi, is responsible for working with the Board in setting the Company’s strategic direction and day-to-day leadership and performance. Mr. Ganzi has substantial experience, knowledge and relationships in the digital industry and our Board believes that having the Chairperson role as a separate position allows Mr. Ganzi to focus on executingcontinued execution of the Company’s digital transformation,business plan, which will best serve the interests of the Company.

In addition, the Board believes that having an independent Chairperson:

| (1) | ||

| increases the independent oversight of the Company and enhances the Board’s objective evaluation of our Chief Executive Officer, | ||

| (2) | provides our Chief Executive Officer with an experienced sounding board in the Chairperson, and |

| (3) | provides an independent spokesperson for the Company. |

Our Compensation, Audit and Nominating and Corporate Governance Committees are currently comprised entirely of independent directors. The Board believes that having an independent Chairperson of the Board and independent Compensation, Audit and Governance Committees provides a structure for strong independent oversight of our management. Each committee chair presides over the chair’s committee meetings and reviews and approves meeting agendas, schedules and other information for the committee. We believe that the Board’s leadership structure, including its independent chair, majority of independent directors, and allocation of oversight responsibilities to appropriate committees, provides effective board-level risk oversight.

Under our Board’s governance, including the number of ad hoc Board committees, our Board, upon recommendation by the Nominating and Corporate Governance Committee, dissolvedGuidelines, if the Chairperson is not an independent director, the independent members of the Board shall elect an independent director to serve as Lead Director, and the Board will develop duties and obligations for the Lead Director. We would expect any appointed Lead Director to generally assume the duties and responsibilities of our independent Chairperson described above.

DIGITALBRIDGE 2023 PROXY STATEMENT |21

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Board’s Role in Risk Committee effective at the 2020 annual stockholders meeting. Oversight

The Board believes that, in consideration of the Company’s ongoing business simplificationis responsible for overseeing and digital transformation, it is appropriate for our Board, as a whole and through its standing committees, to oversee and monitormonitoring our risk management processes.

|  |  | |||||||||

| Compensation Committee | Nominating and Corporate Governance Committee | ||||||||||

AREAS OF RISK | ■ Financial ■ Operational ■ Cybersecurity/Technology ■ Digital Continuity Plans ■ Insurance ■ Foreign Corrupt Practices Act ■ FX Exposure/Counterparty Risk | ■ Compensation ■ Engagement and Oversight of Independent Compensation Consultant ■ Shareholder Engagement ■ HR Matters | ■ Succession Planning ■ Board Refreshment ■ Onboarding ■ ESG Oversight ■ Board Education/Regulatory Developments ■ Board Review and |

In connection with its oversight of risk to our business, our Board and its committees consider feedback from our Chief RiskFinancial Officer, (who manages an internal risk review function), Internal Auditor and other members of management concerning the Company’s operations and strategies and consider the attendant risks to our business. The Board and its committees also engage in regular discussions regarding risk management with our independent and internal auditors. The Board routinely meets with our Chief Executive Officer and President, Chief Financial Officer, Chief Legal Officer and Chief Accounting Officer, and other members of management as appropriate in the Board’s consideration of matters submitted for Board approval and risks associated with such matters.

The Board and its committees hear reports from the members of management responsible for the matters considered to enable the Board and each committee to understand and discuss risk identification and risk management. The chair of each of the Board’s standing committees reports on the discussion to the full Board at the next Board meeting. All directors have access to members of management in the event a director wishes to follow up on items discussed during the Board meeting.

For further information regarding the roles performed by each of our committees, including in connection with risk oversight, see “Proposal No. 1 - 1—Information about our Board of Directors and its Committees.” In addition, the Board is assisted in its oversight responsibilities by the other standing Board committees, which have assigned areas of oversight responsibility for various matters as described in the Board committee charters and as provided in NYSE rules.

22|DIGITALBRIDGE2023 PROXY STATEMENT

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Majority Voting Standard for Election of Directors

Our Bylawsbylaws provide that, in any uncontested election of directors, a director nominee will be elected by a majority of all of the votes cast for and against such nominee at a meeting of stockholders duly called and at which a quorum is present. If in any uncontested election of directors an incumbent director does not receive a majority of the votes cast by stockholders entitled to vote with respect to the election of that director, our corporate governance guidelinesCorporate Governance Guidelines require such director to tender his or her resignation within three days after certification of the results. To the extent that one or more directors’ resignations are accepted by the Board, the Nominating and Corporate Governance Committee will recommend to the Board whether to fill such vacancy or vacancies or to reduce the size of the Board.

Our Corporate Governance Guidelines provide that, whenever a member of our Board accepts a position with a company that is competitive to the Company’s business or violates our Code of Business Conduct and Ethics, Corporate Governance Guidelines or any other Company policy applicable to members of our Board, such Board member must offer his or her resignation to the Nominating and Corporate Governance Committee for its consideration. Such Board member is expected to act in accordance with the Nominating and Corporate Governance Committee’s recommendation in this regard.

Executive Sessions of Non-Management Directors

Pursuant to our Corporate Governance Guidelines and the NYSE listing standards, in order to promote open discussion among non-management directors, our Board of Directors devotes a portion of each regularly scheduled Board and committee meeting to executive sessions without management participation. In addition, our corporate governance guidelinesCorporate Governance Guidelines provide that if the group of non-management directors includes directors who are not independent, as defined in the NYSE’s listing standards, at least one such executive session convened per year shall include only independent directors. Our Lead Independent Director, who effective April 1, 2021, will become Chairperson of the Board presides and will continue to preside at these sessions.

Director Nomination Procedures

Our goal is to ensure that our Board of Directors consists of a diversified group of qualified individuals that function effectively as a group. While it is expected that qualifications and credentials for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of the Board of Directors, our Nominating and Corporate Governance Committee charter provides that candidates for director must have the highest personal and professional integrity, a demonstrated exceptional ability and judgment and an ability to be most effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the Company and its stockholders.

In addition to the aforementioned qualifications, the Nominating and Corporate Governance Committee shall assess the nominee’s independence and may consider, among other things, the following, all in the context of an assessment of the perceived needs of the Board at that time:

| ■ | diversity, age, background, skill and experience; |

| ■ | personal qualities, high ethical standards and characteristics, accomplishments, and reputation in the business community; |

| ■ | knowledge and contacts in the communities in which the Company conducts business and in the Company’s industry or other industries relevant to the Company’s business; |

| ■ | ability and willingness to devote sufficient time to serve on the Board and committees of the Board; |

DIGITALBRIDGE 2023 PROXY STATEMENT |23

PROPOSAL NO. 1: ELECTION OF DIRECTORS

| ■ | knowledge and expertise in various areas deemed appropriate by the Board; and |

| ■ | fit of the individual’s skills, experience, and personality with those of other directors in maintaining an effective, collegial, and responsive Board. |

The Nominating and Corporate Governance Committee will seek to identify director candidates based on input provided by a number of sources, including (a) Nominating and Corporate Governance Committee members, (b) other members of the Board of Directors and (c) stockholders of the Company. The Nominating and Corporate Governance Committee also has the sole authority to consult with or retain advisors or search firms as it deems necessary or appropriate in its sole discretion, including any search firm to assist in the identification of qualified director candidates.

In 2020,2022, as part of our continuing Board refreshment efforts, and Spencer Stuart’s analysis of our Board governance and other matters, we also engaged Spencer Stuart as a third party executive search firm to assist the Nominating and Corporate Governance Committee in identifying, screening and assessing two potential director candidates.

All candidates with digital experience.

Communications with the Board

Our Board has established a process to receive communications from interested parties, including stockholders. Interested parties may contact the Lead Independent Director, who, effective April 1, 2021, will become Chairperson of the Board, at the following address: “Lead Director”

“Chairperson” c/o Secretary Colony Capital,

DigitalBridge Group, Inc.,

750 Park of Commerce Drive

Suite 210

Boca Raton, FL 33487

or by email at leaddirector@clny.com. chairperson@digitalbridge.com.

The Chairperson of the Board will decide what action should be taken with respect to the communication, including whether such communication should be reported to the Board of Directors.

Anti-Hedging/Pledging Policy in order to ensure that related party transactions are properly reviewed and fully disclosed in accordance with the rules and regulations of the SEC and NYSE. All related party transactions, including transactions between us and any executive officer, director, director nominee or more than 5% stockholder of the Company, or any of their immediate family members, where the amount involved exceeds $120,000 and in which such related person has a direct or indirect material interest, must be approved or ratified by either our Audit Committee or a majority of the disinterested members of our Board of Directors. For purposes of the policy, a related party transaction does not include any co-investments made by and between the Company (or its subsidiaries) and one or more investment vehicles formed, sponsored and managed by the Company or its subsidiaries, regardless of when such co-investment is made, or any transactions related to any such co-investment. As a general rule, all related party transactions should be on terms reasonably comparable to those that could be obtained by the Company in arm’s length dealings with an unrelated third party; however, in such cases where it may be impractical or unnecessary to make such a comparison, the Audit Committee or a majority of the disinterested members of the Board may approve any such transaction at their discretion in accordance with the Related Party Transaction Policy.

Our insider trading policy applicable to all employees of the Company, including all of our officers and members of our Board, among others, strictly prohibits at all times (1) trading in call or put options involving the Company’s securities and other derivative securities, (2) engagement in short sales of the Company’s securities, (3) holding the Company’s securities in a margin account, and (4) pledging the Company’s stock to secure margin or other loans, except as otherwise approved by our Board.

| (1) | ||

| trading in call or put options involving the Company’s securities and other derivative securities, | ||

| (2) | engagement in short sales of the Company’s securities, |

| (3) | holding the Company’s securities in a margin account, and |

| (4) | pledging the Company’s stock to secure margin or other loans, except as otherwise approved by our Board. |

24|DIGITALBRIDGE2023 PROXY STATEMENT

PROPOSAL NO. 1: ElectionELECTION OF DIRECTORS

Information about Our Board of Directors

During the year ended December 31, 2020,2022, our Board met on 2712 occasions. Each director then serving attended at least 75% of the aggregate number of meetings of our Board and of all committees on which he or she served.

All directors are expected to attend the annual meeting of stockholders as provided in our corporate governance guidelines.Corporate Governance Guidelines. All of the directors on our Board in May 20202022 attended the 2020 annual meeting2022 Annual Meeting of stockholders.

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these standing committees has adopted a committee charter, which is available on our website at

Investor Relations Colony Capital,

DigitalBridge Group, Inc.,

750 Park of Commerce Drive

Suite 210

Boca Raton, FL 33487 to request a copy, without charge.

In addition, to our standing committees, the Board of Directorshad three additional committees in 2022. In 2021, the Board formed a Demand Reviewspecial committee to oversee special counsel in its engagement relating to the allegations against Thomas J. Barrack, Jr. (the “Special Investigation Committee”). The term of the Special Investigation Committee expired in 2022, and Mr. Barrack was acquitted in November 2022. The members of the special committee were Ms. Diefenderfer (Chairperson) and Messrs. McCray and Rasheed.

The Board also formed two separate independent transaction committees in March 2022 to evaluate demand letters received in 2019 and 2020 from purported stockholdersnegotiate potential transactions involving conflicts of the Company regarding certain allegations made against certaininterest with senior management. The first committee was composed of Mses. Curtin (Chairperson) and Diefenderfer and Messrs. Carter, Fosheim, McCray, Rasheed and Steffens and was dissolved following a decision not to pursue a transaction (the “Dynasty Committee”). The second committee, composed of Messrs. Carter (Chairperson), Fosheim and Rasheed and Mses. Curtin, Diefenderfer and Reiss continues to oversee the Company’s current and former executive officers and directors, which were substantially similar to those allegedinterest in certain class action lawsuits filed against the Company in 2018 and 2020, respectively. In 2020, in connection with the dismissal of the 2018 class action lawsuits, the Demand Review Committee formed in 2019 was dissolved. In connection with the recent dismissal of the 2020 class action lawsuits, we expect that the Demand Review Committee formed in 2020 will be dissolved this year.

Each committee of our Board is composed exclusively of independent directors, as defined by the listing standards of the NYSE. Moreover, the Compensation Committee is composed exclusively of individuals referred to as “non-employee directors” in Rule 16b-3 of the Exchange Act, and “outside directors” in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

2022 Board Committee Rotation

In connection with our Board’s dedication to Board refreshment and our company’s digital transformation, the Nominating and Corporate Governance Committee conducted an extensive evaluation of the skills, qualifications and diversity of our director nominees for the 20212023 Annual Meeting. Following this evaluation, upon the Nominating and Corporate Governance Committee’s recommendation, the Board has approved a rotationthe continuation of itsthe current committee chairpersonscomposition and memberships to take effect on May 3, 2021.chairpersons.

DIGITALBRIDGE 2023 PROXY STATEMENT |25

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The below charts summarizechart summarizes our current Board committee membershipsmemberships. We anticipate that Mr. Tolley will serve as Chair of the Audit Committee and Mr. Brown will join the Board committee memberships effective May 3, 2021.

| CURRENT CLNY COMMITTEE MEMBERSHIPS | ||||||||||||||

| AUDIT COMMITTEE | COMPENSATION COMMITTEE | NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | DEMAND REVIEW COMMITTEE(1) | |||||||||||

| INDEPENDENT DIRECTOR | ||||||||||||||

J. Braxton Carter(2) | — | — | — | — | ||||||||||

Nancy A. Curtin(3) | — | — | — | — | ||||||||||

| Jeannie H. Diefenderfer | M(4) | M(4) | — | M | ||||||||||

| Jon A. Fosheim | M, E | — | C | — | ||||||||||

| Craig M. Hatkoff | — | M(4) | M(5) | M | ||||||||||

Gregory J. McCray (6) | — | — | — | — | ||||||||||

| Raymond C. Mikulich | M(4) | M | — | — | ||||||||||

| George G. C. Parker | C, E | M | — | — | ||||||||||

| Dale Anne Reiss | M, E | — | M | — | ||||||||||

| John L. Steffens | — | C | M | — | ||||||||||

| NUMBER OF MEETINGS HELD IN 2020 | 7 | 13 | 11 | 1 | ||||||||||

| Name | Audit | Compensation | Nominating & Corporate Governance | ||||||||||||||

|  | ||||||||||||||||

Nancy A. Curtin(2) | |||||||||||||||||

| Jeannie H. Diefenderfer |  |  | |||||||||||||||

Jon A. Fosheim |  |  | |||||||||||||||

| Gregory J. McCray |  |  | |||||||||||||||

| Sháka Rasheed |  |  | |||||||||||||||

Dale Anne Reiss |  |  | |||||||||||||||

David M. Tolley |  |  |

| Committee Chair |  | Committee Member |  | Audit Committee Financial Expert |

| (1) | ||

| Mr. Carter is not a nominee for director at the 2023 Annual Meeting. | ||

| (2) | ||

| Ms. Curtin serves as our independent, non-executive Chairperson of our Board. | ||

Audit Committee

Our Board has determined that all five members of the Audit Committee and prospective Audit Committee member and chairperson-elect, J. Braxton Carter, are independent and financially literate under the rules of the NYSE. In addition, our Board has determined that current Audit Committee members, George G. C. Parker (Chairman),J. Braxton Carter, Jon A. Fosheim, Raymond C. Mikulich, and Dale Anne Reiss as well as prospective Audit Committee member and chairperson-elect, Mr. Carter,David M. Tolley are “audit committee financial experts,” as that term is defined by the SEC. The Audit Committee is responsible for the oversight of, among other things, our accounting and financial reporting processes, the integrity of our consolidated financial statements and financial reporting process, our systems of disclosure controls and procedures and internal control over financial reporting, the enterprise-wide risk management policies of our operations, our compliance with financial, legal and regulatory requirements and our ethics program, the evaluation of the qualifications, independence and performance of our independent registered public accounting firm, and the performance of our internal audit function. In addition, the Audit Committee has established and maintains procedures for the receipt of complaints and submissions of concerns regarding accounting and auditing matters. The Audit Committee met seven times in 2022. The Audit Committee Report is included later within this Proxy Statement.

Nominating and Corporate Governance Committee

Our Board has determined that all members of the Nominating and Corporate Governance Committee are independent under the rules of the NYSE. The Nominating and Corporate Governance Committee is responsible for, among other things, identifying and recommending to our Board qualified candidates for election as directors and recommendrecommending nominees for election as directors at the annual meeting of stockholders. It also implements and monitors our ESG program, our board education program and our Corporate Governance Guidelines. It reviews and makes recommendations on matters involving the general operation of our Board and our corporate governance and annually recommends to our Board nominees for each committee of our Board. In addition, the Nominating and Corporate Governance Committee annually facilitates the assessment of our Board’s performance as a whole and of the individual directors and reports thereon to our Board. The Nominating and Corporate Governance Committee met four times in 2022.

26|DIGITALBRIDGE2023 PROXY STATEMENT

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Compensation Committee